CEO’s

Statement

Fiscal Year 2024-2025

"This past year has been nothing short of remarkable for Best Doctors Insurance"

Our results for the fiscal year ending March 31, 2025, reflect the strength of our business, the resilience of our model, and—above all—the dedication of our people and partners.

Today, we’re publishing our FY2025 Financial Condition Report (FCR) for Best Doctors Insurance Limited (“BDIL”) our main insurance company, which provides an in-depth look BDIL’s financial position, risk management, and governance, representing a powerful endorsement of our business.

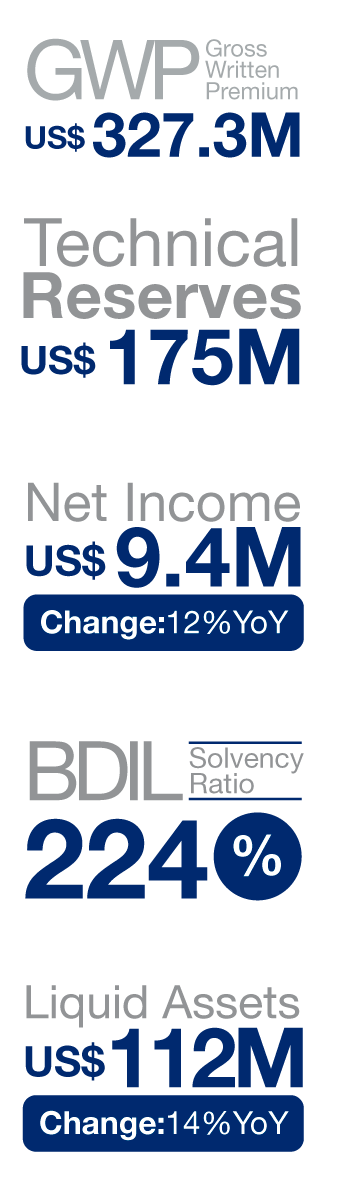

The BDI Group, which consists of BDIL and all other operating entities within the BDI Group of companies, closed the year with a Gross Written Premium of US$327.3 million, a healthy increase, reflecting the confidence placed in us by thousands of clients and brokers.

Our Net Income reached US$9.4 million, a 12% uplift on the prior year, thanks to tighter execution and continued growth in high-quality segments.

Most notably, the Solvency Ratio surged to 224%, underlining just how far we’ve come in terms of financial strength and stability. BDIL’s liquidity is equally strong, with Liquid Assets now at US$112 million, up 14%, giving us the flexibility to act quickly and with confidence. US GAAP technical reserves, the backbone of any good insurer, now stand at US$175 million.

These are more than just numbers. They represent our ability to keep promises, to pay claims, and to grow securely and sustainably.

Supporting this performance is our robust risk management framework, which is fully integrated into our operations. It helps us anticipate challenges, maintain discipline, and protect our solvency—making Best Doctors a more secure and credible partner for brokers, clients, and regulators alike.

Of course, financial performance is only part of the story. What really sets Best Doctors apart is our relentless focus on service and experience—especially in an industry where expectations continue to rise fast.

We made significant progress this year through our Digital Transformation roadmap. Claims turn-around time improved by 18%, with more than 28,000 claims processed via our AI-assisted “Fast Track” system, and a 104% increase in claims submitted through our digital portals.

Beyond claims, we modernized both the Member and Agent Portals, rolled out digital signature integration, and introduced an AI-assisted underwriting engine that’s cutting turnaround times dramatically—all while maintaining accuracy and consistency.

Finally, as we continue transforming our operations, we are also strengthening the partnerships that matter most. This year, we placed renewed emphasis on building deeper, more collaborative relationships with top healthcare providers, ensuring access to high-quality care while unlocking new efficiencies in case management, billing, and service delivery.

These changes weren’t just about technology or contracts. They were about giving our customers and partners faster tools, more visibility, and smoother processes – across the board.

We’re

making

processes

faster, more accurate,

and easier to navigate.

Above all

Our guiding principle remains our customers, partners, and colleagues’ experience. Everything we do must make it easier, faster, and more rewarding to do business with us.

At the core of the delivery of these priorities is data—the foundation that powers everything from smarter underwriting to more personalized service. By leveraging advanced analytics and AI technologies, we predict trends, understand customer needs, and tailor our services accordingly. This approach ensures we stay ahead in the market, making informed and innovative decisions that enhance our offerings and drive continuous improvement.